General

-

not yet implemented in Austria, deadline 6.7.2024 (already passed)

- implementation till 1.1.2025 questionable → Sanctions/Further Deadlines

-

replaces the NFRD in essence

- NFRD still mandatory for large companies

-

applies within EU

- applies to all subsidiaries, even if not in EU

- parent companies which are not in EU are exempted

-

transposition: NaBeG

-

how to look up which member states have implemented a directive

- eur-lex.europa.eu

- under national transposition there is a list of implemetations

Reporting Changes

-

uniform EU-Standards ESRS

- directive needs to be implemented into domestic laws

-

increases requirements for disclosure

- now part of Management Report

- must be in digital and in machine readable format

- same as Financial Statement

- Digital Tagging

-

have to comply in contrast to NFRD

- no explanations anymore, qualitative/quantitative data

-

environment, social, governance covered

-

concept of Double Materiality

- related to EU Taxonomy Regulation

Assurance

- mandatory limited assurance (later reasonable) by a statutory auditor or an independent assurance services proveder (IASP)

- once reasonable assurance kicks in the pressure will increase

- mostly about auditing firms, they cannot yet provide this service

- liabilities are too high

- check for completeness, rather than correctness

- a huge business in auditing companies

- no separate departments currently

- EY Austria acquired sustainability reporting auditing firms, others in the The Big 4 do the same

- once reasonable assurance kicks in the pressure will increase

Topics

- qualitative and quantitave information

- environment

- similar to EU Taxonomy Regulation

- social

- equal opportunities

- working conditions

- human rights

- governance

- role & composition of board/management

- ethics (bribery/corruption and corp. culture)

- political engagements

- business relatioships

- control & risk

- management

Scope

- impacts 50.000 firms in EU

- large firms, listed firms, certain non-EU firms need issue sustainability reports

- includes all subisidiaries

- even if subsidiary not in EU

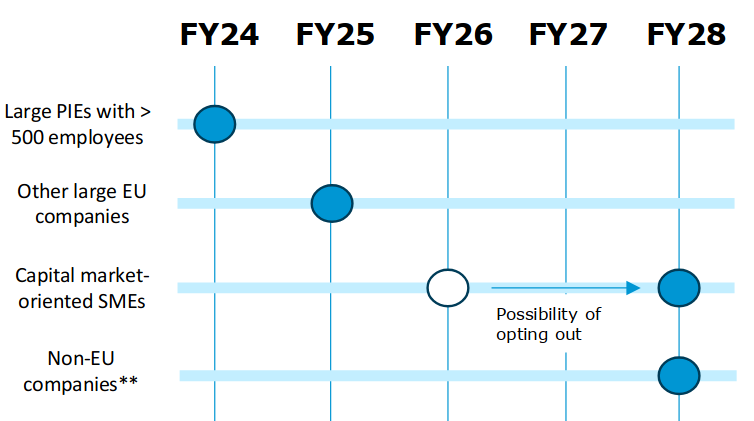

Temporal Scope

Sanctions/Further Deadlines

- possibility of high sanctions

- since alignment with financial reporting sanctions (which are very strict)

- Case A - implementation before 1.1.2025

- in full accordance with ESRS

- Case B - implementation before 30.4.2025

- Case C - implementation after 30.4.2025