What is Finance?

- I need money. Where can I get it from?

- grandma

- bank loan

- financial markets

- I have money. Where can I put it in?

- bank

- invest in property, art, etc

- financial markets

Scope

- financial markets

- instruments traded on financial markets

- how are prices formed

- performance/risk

- notions on profitability/risk

- expected returns, “beating the market”, when does risk matter?

Dimensions of Data

- cross-sectional data

- different entities at the same time

- horizontal vector

- time-series data

- same entity at different times

- vertical vector

- panel data

- different entities at different times

- matrix / dataframe

Sources of Financial Data

- market data

- trade related, transactions on a financial market

- e.g. prices, trading volumes

- accounting data

- survey data

- e.g. LIBOR, market sentiment indices, etc

- data providers (academic and industry providers)

Financial Markets and Instruments

- instrument … something listed on a financial market

- exchange traded

- stocks

- futures, ETFs, some options, etc

- price set by supply/demand

- more regulated environment (trading hours, disclosure requirements, etc)

- over the counter (OTC)

- bonds

- forwards, funds, options, etc

- price set by seller, buyer accepts/declines

- few regulations

Stocks

- you become an owner of the firm if you hold its stocks

- equity is divided into pieces called stocks/shares

- proportional to the number of shares

- usually entails voting rights

- Dividend payed out to shareholders

- vary over time, depending on profit of firm

- Limited Liability - cannot lose more than the shares you own

- in case of default - read here

Bonds

- you become a creditor of the frim if you hold its bonds

- debt financing

- more participants than just a single entity (e.g. bank)

- a “big loan” is divided into smaller ones - bonds

- transfer of bond is easier than shares

- coupons … regular interest payment, usually annual or semi-annual

- like interest, just payed to you

- repayment … the fixed date when the bond is payed back

- called maturity (5y, 10y, 15y)

- e.g. buying a bond with 5y maturity for 10k, after 5y you will receive the 5k back from the company

- primary vs secondary markets

- primary: sold for the first time, IPO, company sets its own beginning prices

- secondary: bought and sold between investors, e.g. on the NYSE

- price discovery: supply/demand

- primary: book building

- secondary: order book

Book building - Simplified

- used for OTC sales

- set reasonable price for stock

- road show … advertise the security to investors or general public

- customers send offers … x amount for y each

- add up the demand and offers

- choose price according to those offers

- allocate stocks to the buyers

- maximize number of transactions

- if there are more offers than supply

- choose highest price to sell all your supply

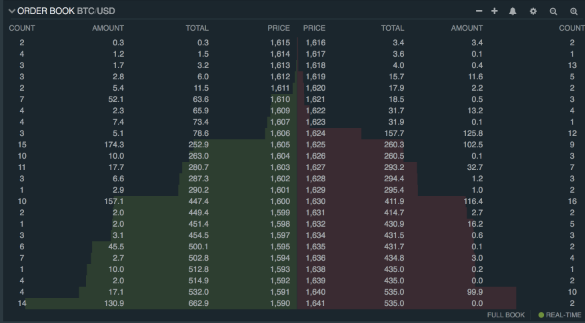

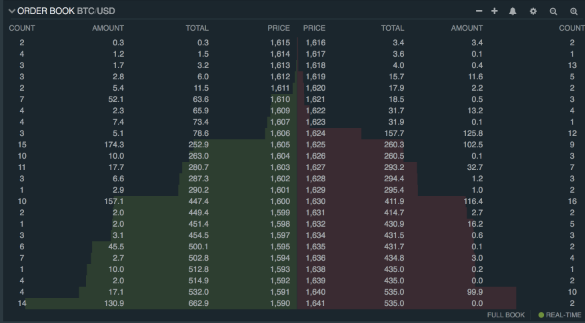

Order Book - Simplified

- used on exchanges

- bid price … what you want to sell it for

- ask price … how much you are willing to pay

- if there is a match i.e. bid price < ask price the transaction is executed

Prices to Returns

- one cannot compare prices, only performance

- performance … relative price change over time interval

- simple return: rt=pt−1pt−pt−1=pt−1pt−1

- log return: rtl=log(pt/pt−1)

- note: rt=ertl−1

Stylized Facts

- returns are hard to predict

- maybe 1 minute into the future

- returns have fat-tailed distributions

- more extreme observations than in normal distributions

- normally smoother curve, peak not as high

- average is normally around 0

- volatility clusters

- volatility … different between high/low

- volatility is “exploding” during short times and stays like that for a short while before calming down again

- correlation tends to spike/increase during market downturns / crashes

- individual stocks follow downwards but move up separately