No more givens

- until now prices were given

- now not anymore

Overview

| Buyers / Sellers | One | Few | Many |

|---|

| One | Bilateral monopoly | Limited Monopoly | Monopoly |

| Few | Limited Monopsony | Bilateral oligopoly | Oligopoly |

| Many | Monopsony | Oligopsony | Polypoly |

Competition vs Monopoly

- competition ⇒ Monopoly

- many sellers buyers ⇒ one seller, many buyers

- homogeneous good ⇒ single product

- free entry for competitors ⇒ limited entry (Market Entry Barriers)

- price is given ⇒ price is set by company (high market power)

- p = MC, p = AC ⇒ profit is maximized by output of q where MR=MC

Market Power

- if players in an Oligopoly are talking to one another they can form an almost monopoly where they can plan their joint supply

- results in market power similar if not equal to monopoly

- market power … ability to influence the market

- in perfect competition the price is given → 0 market power

Math and Stuff

Marginal Revenue Function (Linear)

- demand/price: P(Q)=a−bQ

- Revenue: R(Q)=P(Q)∗Q=(a−bQ)∗Q=aQ−bQ2

- MR(Q)=a−2bQ

- same curve, but with twice the slope

Increasing Production

- increasing production will increase the revenue

- but the price needs to be adjusted → demand stays equal

- MR<p … Marginal Revenue always optimal, production below optimum

Price Setting

- in a monopoly there is 1:1 mapping between price and demand

- we can choose the price and find out about the demand then

- very easy to calculate the revenue

- optimal production rate when factoring in costs

- Marginal Costs = Marginal Revenue is best production cost

- MC=MR

- from that we get the optimal quantity to produce

- from what we can get the price with the demand function

MR=p+pεd1

- εd … elasticty → Micro Formula Sheet

- in perfect competition: εd=−∞⟹MR=p

- constant marginal revenue: horizontal curves

- small price increase → complete loss of demand

- market power: −1>εd>−∞⟹MR<p

- negatively sloped market demand & marginal revenue curves

- inelastic demand −1<εd<−∞⟹MR<0

- negative marginal revenue → choose an output level which is in elastic demand

Optimal Prices

p=mMC

Lerner Index

pp−MC=−εd1

- Lerner index … left side

- 0<L<1

- the higher the Lerner index, the less competition

- the higher the markup, the less competition

| Industry | Lerner Index | Markup Factor |

|---|

| --- | | |

| Food | 0.26 | 1.35 |

| Tobacco | 0.76 | 4.17 |

| Textiles | 0.21 | 1.27 |

| Apparel | 024 | 1.32 |

| Paper | 0.58 | 2.38 |

| Chemicals | 0.67 | 3.03 |

| Petroleum | 0.59 | 2.44 |

Measuring Monopoly Power

- Lerner Index 1 → complete Monopoly

- Lerner Index 0 → perfect competition

- everything in between is some gradual change between extremes

Monopoly and Demand

- more elastic demand → lower markup

- less elastic demand → higher markup

HHI Index

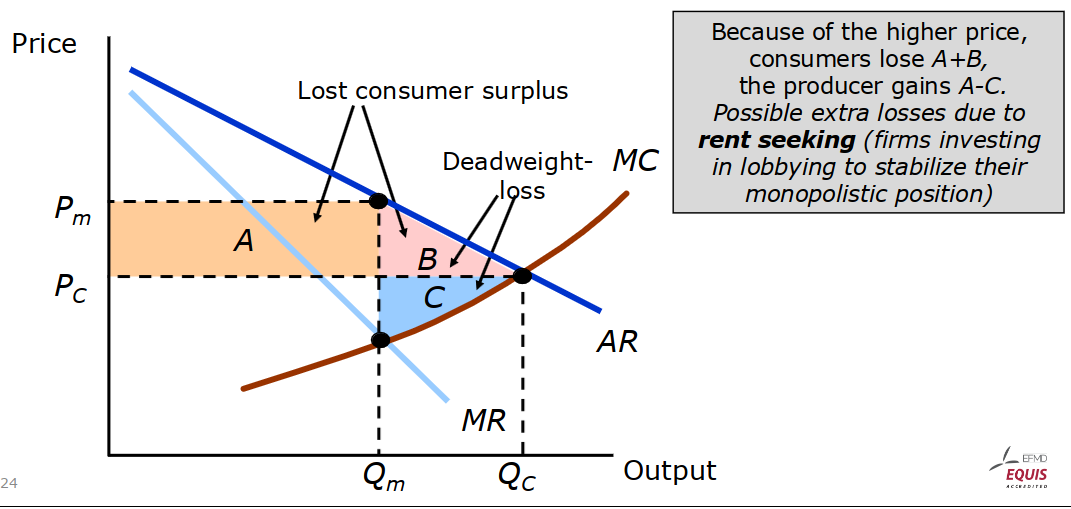

Social Cost

- consumer surplus … difference between willingness to pay and actual price

- producer surplus … profit + fixed costs

- monopoly produces less units at higher price

Natural Monopoly

- similar to Economy of Scale

- when a single company can produce all the supply cheaper than if the load was split among multiple companies

- very high fixed costs, low variable costs

- subadditive cost function … f(x,y)<f(x)+f(y)

- examples:

- Railroads

- Roads

- Telecommunications

- Electricity

Regulating the Price

- setting ceiling to the competitive level → not good

- at this level the company would not work

- setting ceiling such that the company has no profit → perfect

- company is willing to produce, but has little to no profit

- best for maximized consumer surplus

- infeasible due to lobbying and political ambitions

Different Production Costs

- marginal costs should be equal in all sites MC1=MC2

- first-order condition still holds:

- only partial redistribution of production, not complete redistribution

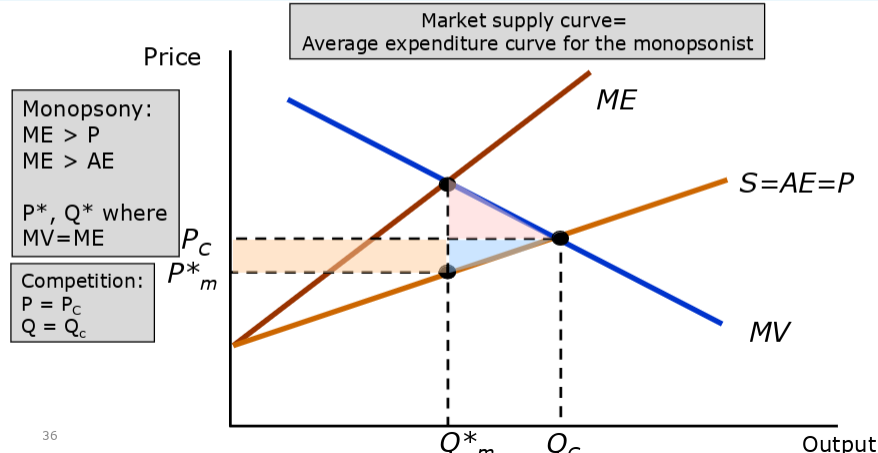

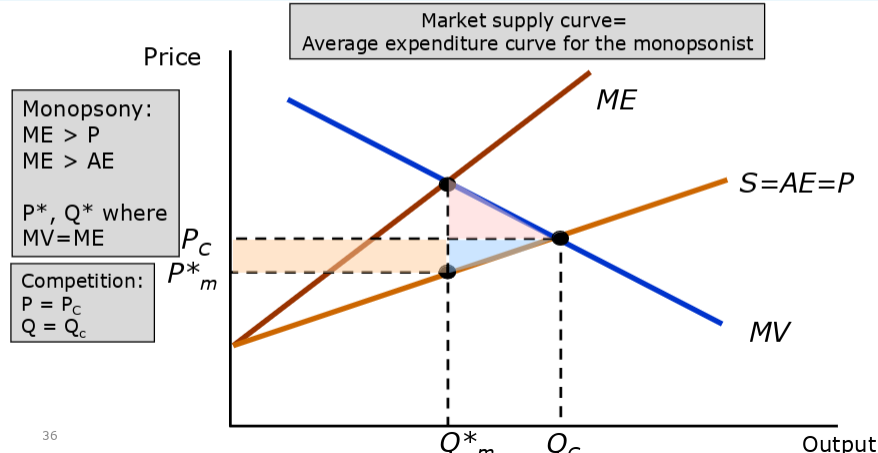

Monopsony

- exact opposite of monopoly

- all market power with demand side

- e.g. military, labor market (in certain industry)

- military is just 1 per country, but with many defense contractors

- labor market can force low wages with lower amount of people

- instead of profit there is net value

- Marginal Value = Marginal Expenditure

- monopsonist buyer wants to maximize net value

- sources of power

- inelastic market supply

- small number of buyers (or just 1)

- little competition between buyers

- Monopoly: Marginal Expenditure = Actual Expenditure = Supply = Value

- Monopsony: Supply = Average Expenditure = Price

- basically suppliers are forced to produce below market value

Monopoly vs Monopoly