Glossary

Info

subscript and superscript used mixed on the slides e.g. can be found instead of , but it is identical

- and … Supply and Demand

- supply = all of all firms added up

- and … Revenue and Costs

- … fixed costs

- … Quantity of x

- … Price of x

- … Elasticity of x

- … Optimum/Equilibrium of X (Price, Quantity)

- sometimes used as and in duopoly

- … another Optimum of X

- e.g. when comparing competition vs monopoly

- … Profit of x

- … joint profits

- … Marginal X (Revenue/Costs/Profit)

- … Average X (Costs, Variable Costs, Revenue)

- … total X (costs, revenues)

Basics

Important

I use capital letters in general formulas or for results, lowercase letters for inputs and when using the formulas. When calculating the equilibrium quantity I use When calculating the profit at a quantity I use

- Equilibrium:

- Elasticity:

- Cross-Elasticity:

Perfect Competition

- Maximization:

- at :

- Profit:

- Supply:

- fixed costs included

- long run: … more competitors enter market, price falls until and

Monopoly

- … Revenue function with twice the slope → why?

- optimal price rule of thumb:

- … … markup

Third Degree Price Discrimination

Two-Part Tariffs

- … per-unit price; … buy-in price (lump-sum fee)

- or

- … consumer surplus of the consumer group with smaller demand

- (linear demand curve → triangle)

-

- if

- … amount of customers in all groups, … amount of consumer groups

Oligopoly

Collusion / Cartels

- just use the Monopoly instead of oligopoly formulas

When what?

Competition on (x + y) results in behavior:

- price + sequential = price leadership

- quantity + sequential = quantity leadership (Stackelberg)

- price + simultaneous = Bertrand

- quantity + simultaneous = Cournot

Price Leadership

- firm 1 sets price in anticipation of firm 2’s reaction

- firm 2 takes price of firm 1 as given, adjusts accordingly

-

- … parameters

Stackelberg

- firm 1 sets output in anticipation of firm 2’s reaction

- firm 2 takes output of firm 1 as given, adjusts accordingly

-

- … parameters

Bertrand

- maximized price (same for ):

Cournot

- optimized quantity (same for ):

Amoroso-Robinson Formula

-

- … elasticity of demand (not market elasticity)

- perfect competition:

- loss of demand with small price change

- market power/monopoly:

- negatively sloped market demand & marginal revenue curves

- inelastic demand:

- negative marginal revenue → not optimal!

Lerner Index

→ perfect competition → monopoly

Surplus

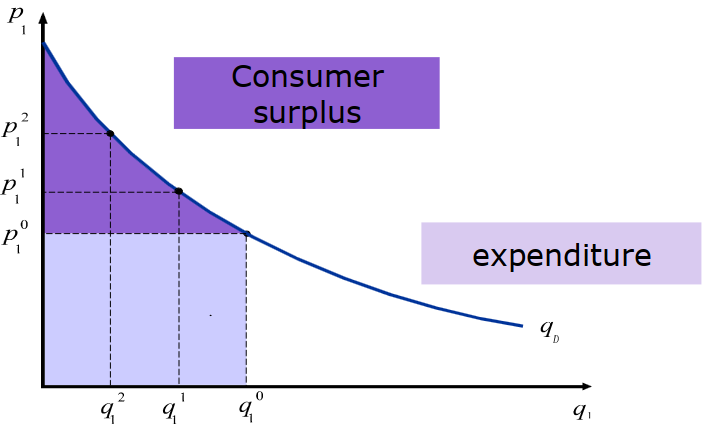

Consumer Surplus

- area between demand function and given price

- derivative - rectangle

- OR with linear quantity just a rectangle ()

Tax Burden

- on consumers:

- on sellers: