30 year crisis (1914-1945)

Interwar period

- no world trade during WW1

- won’t trade with my enemies

- Gold Standard + financial markets collapsed

- increase in oil prices

- banking crisis after 1930

- a lot of changes to Interest Rate

- before in range of 0-2%

- then stark change between great inflation and deflation

- larger share of GDP spent by government

- 1/2 or 2/3 of GDP spent on war efforts

- unsustainable long term

- increased taxation

First World War (1914-1918)

- social and economic costs

- war kills people → destroying human capital

- wiped out 3 years of economic development

- world GDP of 4 trillion

- 8 trillion lost due to damages

- 4 trillion lost due to human capital loss

- disrupted international trade/markets

- high national debt

- new countries (e.g. Poland) → new borders with new conflicts

- attempts of “going back to pre 1914” failed

- overshot on fighting inflation

- new societal and political notions/changes

- autocratic regimes less popular

- new parties on right and left

Spanish Flu

- 17-50 million killed

- especially in poor countries

- no identifiable tradeoff between saving lives and saving the economy

- governmental changes

- emphasis on health and social services

War Finance

- no established mechanisms for financing multi-year wars

- methods of government getting money

- higher taxes (revenues)

- internal public debt - borrow from population → Bond

- external public debt - borrow from other governments

- print money → inflation, Gold Standard abandoned

- inflation devalues domestic debt, convenient

- protectionism hinders cooperation and global transactions

- winners wanted losers to pay for all damages

- Germany forced to pay 260% its GDP in damages

- Germany did not pay → occupation by allies

- then Germany Hyperinflation in 1923

- new negotiations → only pay back 40% of GDP until 1988

- not happening, because WW2

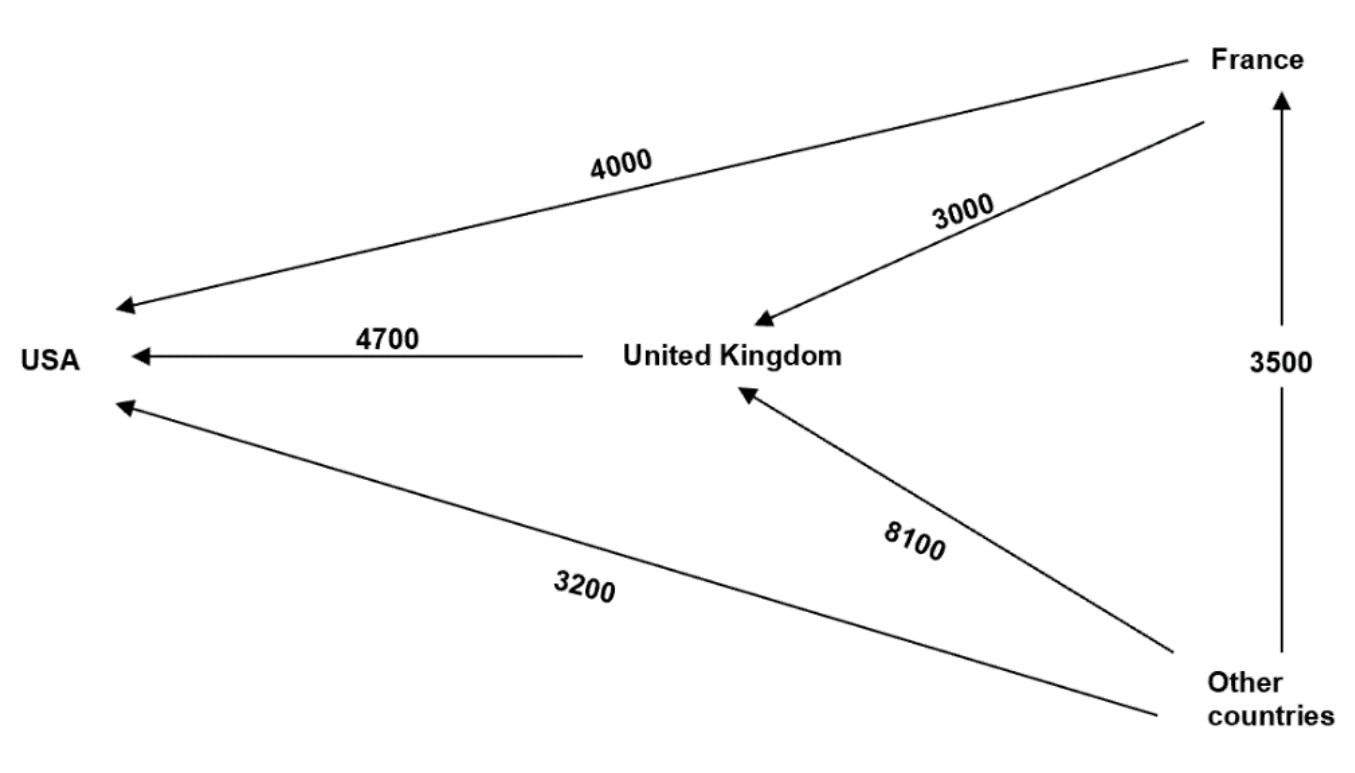

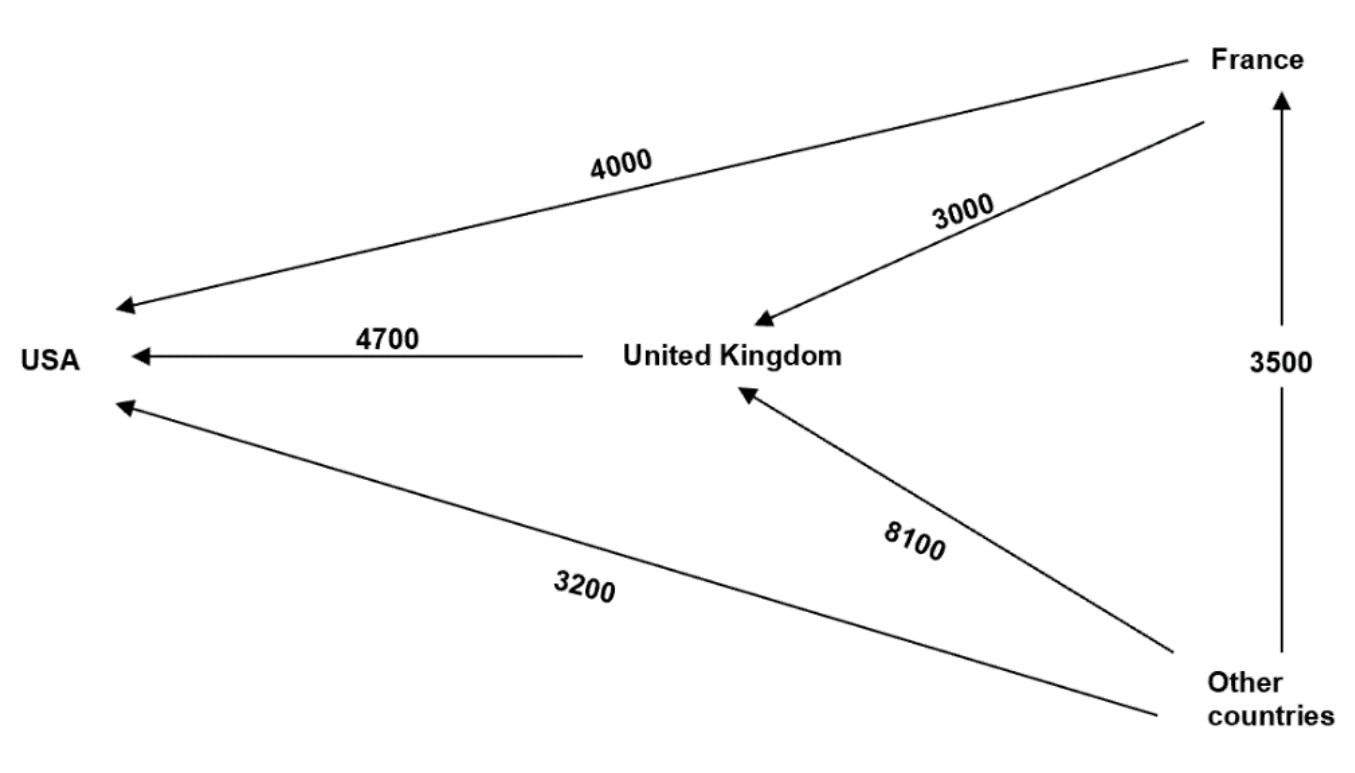

Debt Chain

- countries which borrow their borrowed money to other countries

Postwar Stabilization

- return to Gold Standard

- figured out Self Stabilizing Mechanisms

- limit of interest rates → might depress economy

- dependent on trust in the gold standard

- many core countries were not trusted, had to build trust again

- tight monetary policy

- no money printing

- intependent central banks

- balanced government budgets

- if IS-LM Model did not have monetary and fiscal policy, since need to abide the rules, available during crisis the model fails and so does the economy

Rise of US as new economic leader

- economic boom in 20s

- tractors, Taylorism, electricity, consumer credit, modern marketing

- central capital provider for Europe

- stock market boom + crash in 1929

- taking creditors away from Germany

- hard for Germany to find funding

- link to Great Depression a year later → connection is not as direct as it may seem

Great Depression

- monetary reasons

- stock market crash

- deflation

- banking crisis

- countries defaulting (public debt too high)

- real economy reasons

- industrial production falls

- agriculture crisis

- employment and world trade falls

- institutional reasons

Debt Deflation and Banking Crises

- Crisis led to lower prices and increased debt burden

- Rise in credit defaults

- US banks hit due to short-term deposit base

- Banks’ liquidity and solvency challenges → caused bank runs

- Europe: struggles with foreign loan recalls

- Default in primary product exporting governments due to price drops

- Several banking crises globally (1930-33)

Causes of the Great Depression

- The gold standard’s restrictions

- Prevented effective monetary/fiscal solutions

- International distrust spread due to recall of loans

- Governments cut budgets amidst revenue falls

- Protectionism worsened global trade

Gold Standard and Deflationary Policies

- Countries adhering saw 20% price drops (1929-31)

- Leaving gold standard helped stop deflation

- UK left in 1931; US in 1933; France in 1936

- Spain unaffected by gold standard woes

Economic Recovery Strategies

- Leaving gold standard allowed focused fiscal/monetary policies

- Political and trade blocks instead of open markets

- Notable countries left gold, helping curb deflation

- UK experienced economic recovery earlier than others

- US initiated recovery via the New Deal under Roosevelt

- Focus on public works and social security

Consequences of Abandoning the Gold Standard

- UK devalued currency, aiding economic resurgence

- Other countries followed suit facilitating recovery from depression

Political Implications

- Austerity in Germany impacted democracy, aiding Nazi rise

- Extremism in other nations linked to economic stress and poor policy response

Summary of Depression Causes

- Deflation due to gold standard and stringent monetary policies

- Demand and supply imbalances post-WWI

- Protectionism hindered international recovery