1 Goods Market

a) Graphically

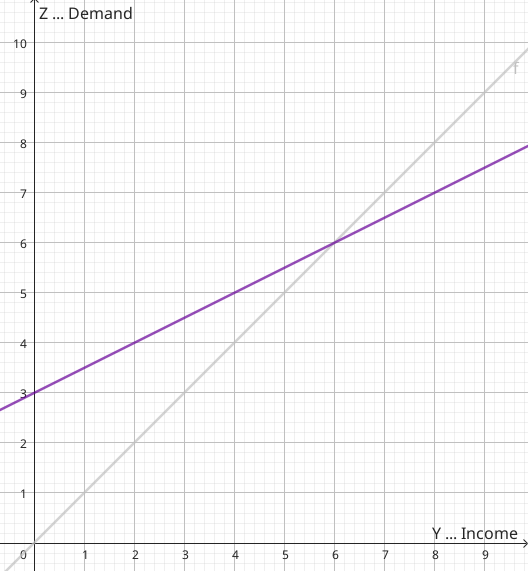

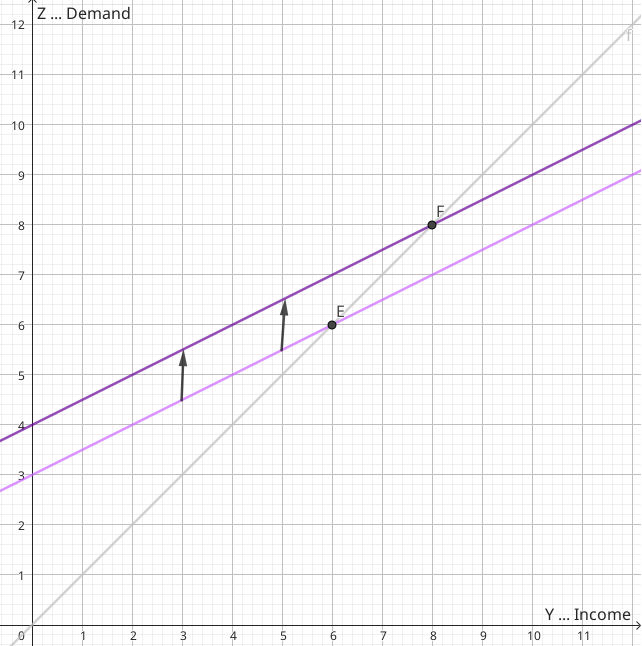

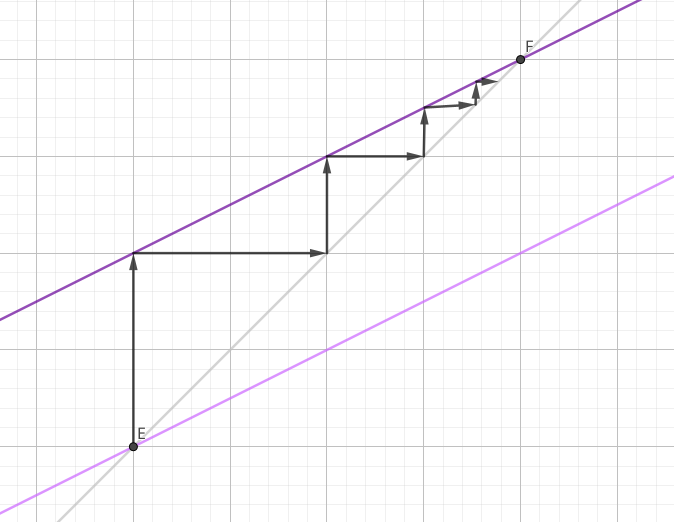

When taxes decrease, then

- taxes decrease,

- disposable income increases,

- consumption increases,

- demand increases,

- income increases,

- disposable income increases,

- loop The equilibrium graphically shifts from point E to F.

b) Multiplier Effect

Since the function is sloped less than the reference line every increase in income has a larger increase in . This is due to the fact that the propensity to consume is usually between 0 and 1, such that in the formula:

6 Nominal and Real Interest

a) nominal vs real

Nominal interest rate is measured in absolute units of currency, which has a downside: inflation is not taken into account. Real interest rate always references a fixed price level in the past such that interest rates can be compared without inflation. This is done by discounting for the inflation of the past. We will explore this more in 6c.

b) investment and consumption decisions

The real interest rate is important for investment decisions. Since the real interest rate measures the cost of borrowing money and real returns a high real interest rate signals high real returns. The nominal interest rate is important for short-term consumption decisions, since if nominal and real interest rate deviate either more or less conservative spending is encouraged since the opportunity cost of spending is higher/lower than the real interest rate.

7 Fisher Parity

a) Approximation

b) Example

- nominal … = 6%

- expected inflation … = 1%

- real interest … = 6 - 1 = 5%