- Money and other financial assets

- Interest Rate

- central banks and commercial banks

Household Decisions

graph LR

A(Income)-->B(Taxes)

A(Income)-->C(Consumption)

A(Income)-->D(Saving)

D-->E(Wealth)

E-->F(Money demand)

E-->G(Other assets, eg bonds)

Fiscal Policy

- issued by government

- levels of government spending and taxes

- also where the spending and taxing is happening

Monetary Policy

- issued by central bank

- changes in money supply

- setting Interest Rate for a region

Market Operations

Money Demand

- the amount of money people want to hold, aggregated

- in personal finance: non-dispensable income

- dependent on income and Interest Rate

Money Supply

- decided by central bank

- equilibrium =

- therefore →

Open Market Operations

- buying/selling own bonds

- increase money supply: expansionary open market operation

- lower Interest Rate

- buying of own bonds → Share Buyback, reducing available bonds

- and/or → → → → loop

- government budget credit → lower GDP

- decrease money supply: consolidation/contractionary open market operation

- higher Interest Rate

- selling of own bonds → issuing additional bonds

- and/or → → → → loop

- government budget debt → higher GDP

- no “setting” of interest rate

- just selling/buying enough bonds to adjust interest rate accordingly

- interest rate increases when income increases

- interest rate decrease when money supply increases

Fischer Equation

… real interest rate … nominal interest rate … expected inflation

Negative Real Interest

- can never be less than 0 → lower bound

- can only ever be negative (deflation) when

Financial Crisis

- risk premium …todo

- response: fiscal policy and monetary rate

Unconventional Methods

- qualitative easing

- quantitative easing

- buying bonds → more money in the economy

- selling bonds → less money in the economy

Where does money come from

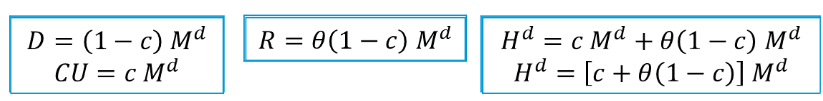

Central Banks

- assets

- bonds (Open Market Operations)

- liabilities

- central bank money (H)

- currency (CU)

- reserves (R)

- NO EQUITY

Commercial Bank

- assets

- loans

- bonds

- reserve at central bank

- liabilities

- checkable deposits

- equity

Money Multiplier