Assumptions

- linear consumption function

- closed economy

IS-LM Model

the IS-LM Model is used to model how the GDP changes from one year to another. A short-term model compared to the long-term methods mentioned previously.

… Investments (private and companies) … Government Expenditure … Consumption (private individuals) … Exports … Imports … Net Exports

Assuming a closed consumption:

Consumption

a function defined on disposable income: … Taxes … “substistence” consumption (base consumption) … (marginal) propensity to consume when income increases

with a linear model we end up with:

… investment rate (because one can either spend or save income)

Investments

- interest rate: Exogenous Number

- interest rate … cost of borrowing money

- if borrowing money is more expensive I can borrow less, therefore invest less

- assumption: linear investment function

Government Expenditure

- Exogenous Number

- would be dependent on taxes … not in this model tho

- e.g. roads, universities, wages

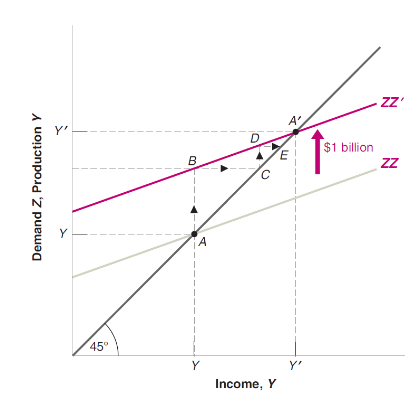

Putting it all together

Equilibrium

aggregate demand = aggregate supply This will be a classic line

Where both lines meet the equilibrium is located

- line 1:

- line 2:

Equilibrium

- private saving:

- income - taxes - consumption

- government saving:

- taxes - government spending

Transformations

more government expenditure → … multiplicator, Fiscal Multiplier

more taxes → … fiscal factor for taxes

Paradox of Thrift

- when saving more (decrease ) the GDP decreases in the short run

- but the savings will finance the long-run development

- Ricardian equivalence theory

Fiscal Multiplier

There are economies where the fiscal multiplier is smaller than 1.