Perfectly Competitive Market

- price taking

- a lot of firms on market

- each firm has small market share

- no price setting power within individual firm

- each firm takes market price as given

- product homogeneity

- perfect substitutions between products

- no firm can raise price beyond market price realisticly

- free entry and exit

- no entry or exit costs → suppliers easily enter/exit market

- buyers can switch between suppliers easily

- FULL INFORMATION

Price Elasticity

- Firm has to take market price as given

Profit Maximization

- Profit Function

- … Quantity

- Marginal Revenue → Marginal Changes

- Second order condition:

- … must be a maximum → otherwise solution does not make sense

- Profit function must be concave

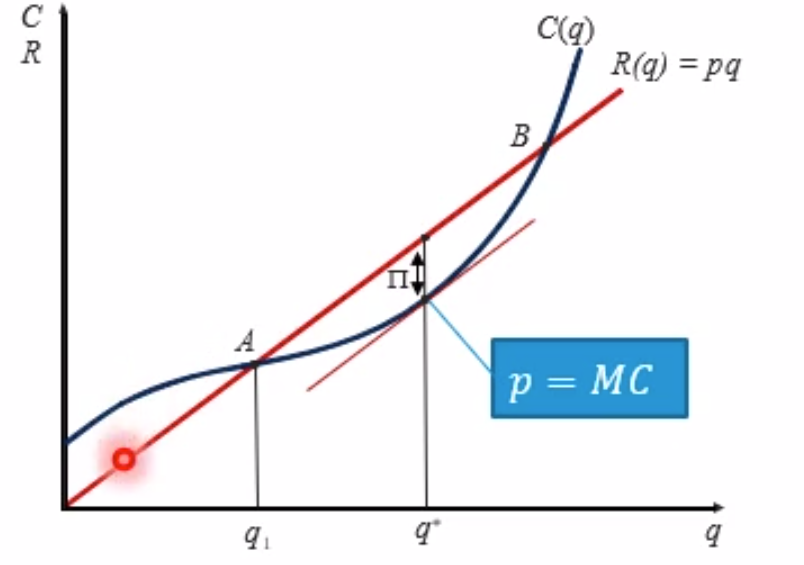

Graphical Solution

- finding largest difference (distance) between revenue function (linear, red) and costs (black, curved)

Demand Curve

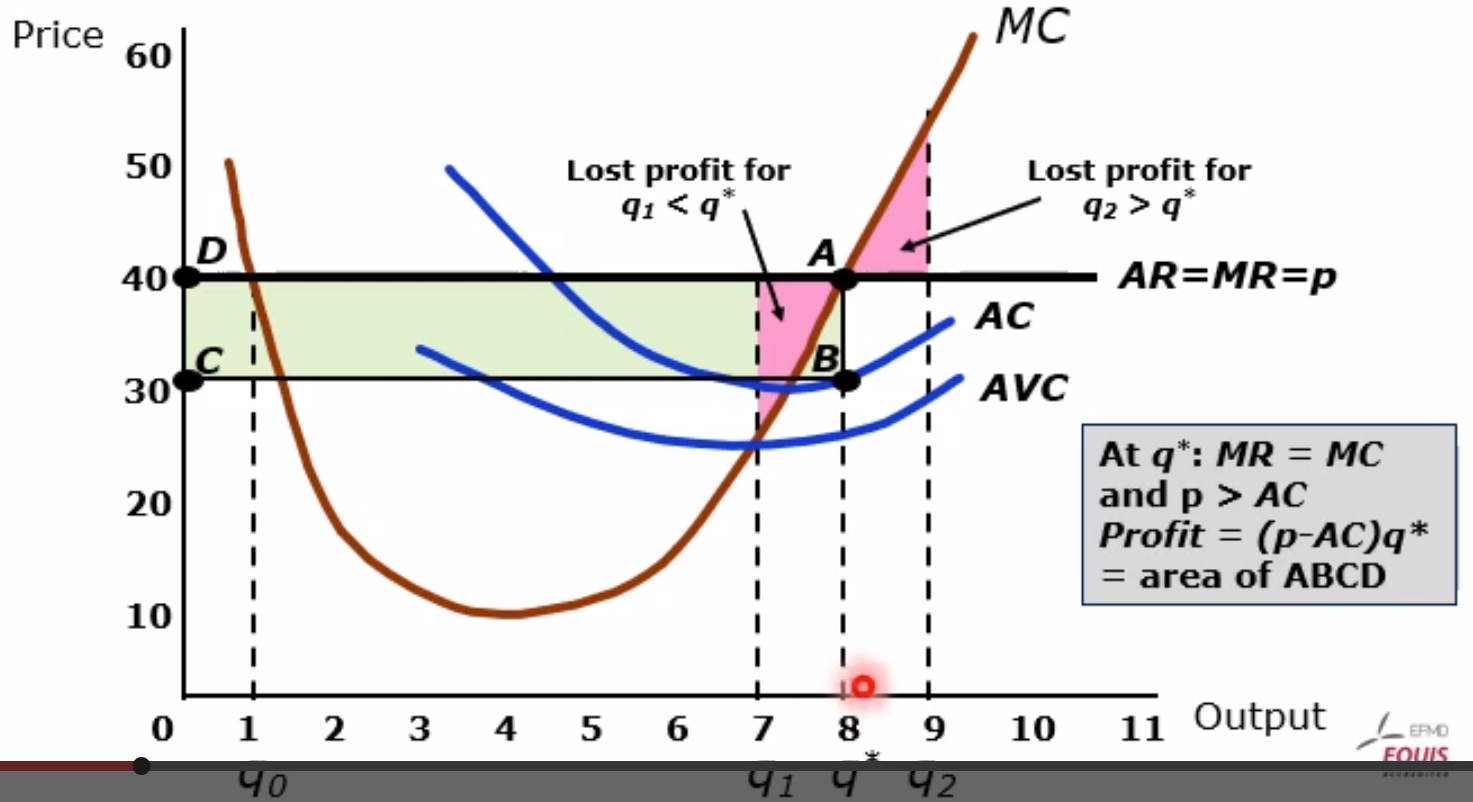

Graphical Solution

- red area → loss of producing more or less than optimal quantity

- have to ensure that producing at the best conditions is better than shutting down

- saving on fixed costs outweighs the opportunity cost

- if fixed costs cannot be saved, then operating normally is more beneficial

Shut Down Rules

- if fixed costs are sunk → Past Sunk Cost

- cannot shut down easily, producing is still better than stopping

- if fixed costs can be recovered / saved → closing is feasibile

Graphical Solution

- own Average Variable Cost must be below industry minimum Average Variable Cost

- Otherwise there could never be a profit

Industry Supply

- aggregation of all suppliers

- summing up

Equilibrium

- Equilibrium

- market clearing price reached → optimal price

- no excess supply → optimal supply

Long Range Equilibrium

-

equilibrium has been reached

-

now increase in demand (e.g. change in taste)

-

positive profits lead to new players enter the market

-

new players means increased supply and lower prices

-

lower prices result in zero profits

-

equilibrium reached again

-

can be run equally for decrease in demand

-

profit in the long run is 0

-

only supply and demand change, price will not

Competitive Equilibrium

- if costs are … then the long-term supply function is …

- constant → horizontal

- increasing → increasing

- decreasing → decreasing (Economy of Scale)

Short vs Long Term Equilibrium

-

short term

- Average Variable Cost is lower limit of price, otherwise shutting down

-

long term

- (profitability attracts more firms)

- supply increases, prices fall, until

- equilibrium reached → zero profits in long term

Zero Profit Condition

- does not mean that there is no money to be made

- competitive firms are compensated for opportunity costs

- there is no superior investment alternative for them

- no use selling the business and going after a more lucrative business

- Opportunity Cost is important

- implicit costs, fictitious employers salary, lost rent revenue

Welfare Characteristics

- 2 parties: Suppliers (Firms) and Consumers

- Consumer Surplus vs Supplier Surplus

- what each party gets from the interaction

- Supplier Surplus = Profit

- Pareto Efficiency → maximization of welfare

- welfare … supplier and consumer surplus

- no definition about distribution of surplus

- one being better off is at the cost of the other

- any Market Failure leads to efficiency loss

Maximum Price

- price ceiling can only be effective if below equilibrium price

- otherwise still equilibrium price → no effect of policy

- supply is restricted, demand increases

- producers are hurt, since less producer surplus

- Deadweight Loss

- Total Surplus is less than before

- consumer surplus is greater than supplier surplus

- if consumer surplus is greater than without policy (at cost of producer surplus) then consumers are effectively better off, otherwise just worse for everyone

- again: possibility of hurting both suppliers and consumers

- especially with highly inelastic products

- drugs (additive as well as medical)

- housing

- basic food items (potatoes, bread, rice)

Minimum Price

- e.g. minimum wage, essential tax on alcohol, tobacco

- price floor can only be effective if higher than equilibrium price

- otherwise still equilibrium price → no effect of policy

- demand decreases, supply increases

- suppliers (workers) are hurt, since less suppliers surplus

- overall welfare decreases

Price Support

- government as another consumer → increases demand

- consumer surplus decreases

- producer surplus increases

- overall welfare has increased

- still a Deadweight Loss since Government pays for more than is gained globally

Production Quota

- maximum quantity to be produced

- companies would like to produce more, but cannot

- consumer surplus decreases

- producer surplus increases

- overall welfare has decreased

- governmental payments for voluntary production restriction

- larger than overall surplus loss

- Deadweight Loss again

Import Quota

- maximum quantity to be imported into country

- trade restriction

- results in lower price → market will adjust to price change

- consumers surplus increase

- producer surplus decreases

Import Tariff

- bridge between domestic and world market price

- limiting imports → less imports than without tariffs

- producers will supply more, consumers will demand less

- government will receive tariff amount

- Deadweight Loss (potentially) again

Examples

- Lump-Sum Taxes

- e.g. taxes on profits

- Taxes on Consumption: Consumption taxes

- e.g. VAT

- analogous to decreasing the price, similar to Maximum Price

- 2 prices, 1 which consumers are paying, 1 which producers are producing with

- government receives quantity * tax

- overall loss of welfare → Deadweight Loss

4 Conditions

- Quantity sold and buyers price, must be on the demand curve

- Quantity sold and sellers price, must be on the supply curve

Incidence of a Specific Tax

- demand is inelastic → tax burden on consumers

- supply is inelastic → tax burden on suppliers

- Tax burden on consumers in % =

- Tax burden on consumers in % =

Subsidy

- government pays some part of the price

- increases demand

- Deadweight Loss again