Definition

Framework about strategic, interactive situations

Info

Game … interaction between multiple agents which effect the others Player … actor, agent in this interaction

History

- John von Neumann 1928

- John Nash 1949

- theory of Neumann and Morgenstern

- Nash Equilibrium

- Selten: subgame perfection 1965

- Harsanyi: incomplete information 1967

- Maynard Smith: evolutionary games 1972/82

Nobel Prizes

- 1944 von Neumann, Oskar Morgenstern

- 1951: John Nash for Nash Equilibrium

- 1965: Selten for subgame perfection

- 1967: Harsanyi for Incomplete Information Games

- 1972/82: Maynard Smith for Evolutionary Games

- 1994: John Nash, Harsanyi, Selten

- 2005: Aumann, Schelling

- 2007: Hurwicz, Maskin, Myerson

- 2012: Roth, Shapley

- 2014: Jean Tirole

- 2017: Richard Thaler

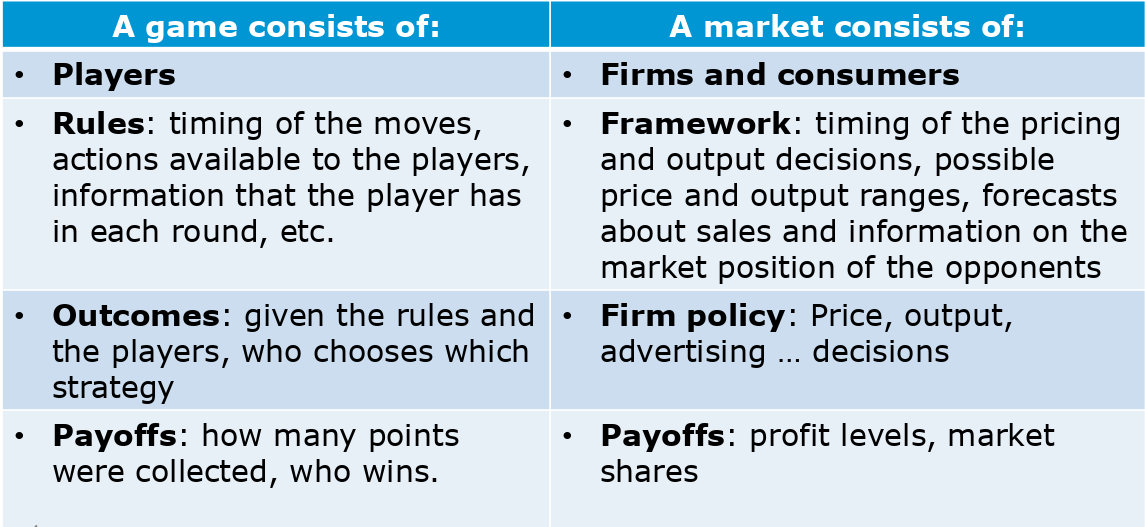

Games and Competition

- sequential or constant game

- game plan

- each player has a predefined action/reaction trees

- imagine chess with pre-planned moves (e.g. chess openings)

- no game plan for chess (too many options)

Assumptions

- every actor understands the payoffs of the game

- players have preferences

- Rationality - all players are rational → maximize payoffs

- complete knowledge

- all information is available to everyone

- everyone knows that all information is known by everyone

- players have unlimited reasoning and calculation ability

Criticism

- players are not rational

- not all players have all knowledge

Nash Equilibrium

- Nash Equilibrium

- for all players the utility has been maximized given the actions of the other players

- i.e. sticking to the current (best) option, since every other option is inferior for every player

- there can be more than one nash equilibrium, but there must always be at least one

- mathematical notation

Payoff Matrix

Types of Games

- static/simultaneous vs dynamic/sequential

- pure-strategy equilibrium vs mixed-strategy equilibrium

- complete information vs incomplete information

- information asymmetry → Economics of Information

- we will only cover complete information in Micro

- incomplete games in DS Decision Sciences

Solutions of a Static Game

- find the possible strategies of all players

- determine the payoffs

- find optimal strategies of all players

- reach Nash Equilibrium

Strategies

Multiple Equilibria - Battle of the Sexes

- when 2 strategies are exactly opposite to one another

- combination of all payoffs are equally beneficial

- multiple predictions are valid

- actual solution is outside of scope of analysis

- i.e. depending on actions of actors the system will reach any Nash Equilibrium

- 2nd order decision

- if there are multiple equilibria i.e. equally well for me

- then I can choose the equilibrium which hurts other player(s) the most

- Football vs Opera Game

Prisoners Dilemma

Maximin Strategy

- no complete rationality or not fully informed players

- even tho a Nash Equilibrium may be possible there is still the risk that the other player does not follow the optimal strategy

- when e.g. an investment is risky then it might be better to leave the dominant strategy and choose the risk-averse strategy

- risk-averse strategy → maximin strategy

- asking: “what is the worst thing that can happen?” for all possibilities

- maximin strategy → choose the best worst thing

No Solution - Mixed Strategy

Solutions of a Dynamic Game

Repeated Games

- giving a new spin to Dilemma Games

Finite Games

- game is played a number of times

- last-move optimization → state at last move will be nash equilibrium

- deviations from equilibrium are only possible, if the deviation is not punished in the next turn/state of the game

- First Mover Advantage can be meaningful

Info

- extensive form → decision tree

- think about pre-move decisions in chess

- Backward Induction

Infinite Games

- a game is not just played once, but infinitely many times

- i.e. there is no last move → no last-move optimization

- genuine repetition dynamics can flourish

- e.g. cooperation

- Discounting for future earnings

- First Mover Advantage only limited

Tit-for-Tat Strategy

- I do what you did to me last time

- this can sustain collusion for long times, even when there are disruptions

- Stackelberg Model

Grim Trigger Strategy

- I will collude, until you cheat only once

- after the first cheat, I will always compete with you

- this can sustain collusion for long times, until there is any disruption

Goals of Firms

Which actions give me an edge in the market?

- make entry unattractive → Market Entry Barriers

- best case: Monopoly

- hurting competitors

- reduce output

- stop producing entirely (exit market)

- setting threats

- empty threats

- threats against player with dominant strategy are futile

- they will always be on top of others, you can only reduce the overall social optimum

- empty threats

- First Mover Advantage - if present