Principle

- working capital = current assets - current liabilities

- working capital → money which is not resulting in long-term profits

- current assets are used to build and sustain revenue

- long term profits come from non-current assets

- e.g. new machines → cheaper production → larger margin

Too High Working Capital

- might be too much Inventory → hard to sell

- many firms are trying to reduce their working capital

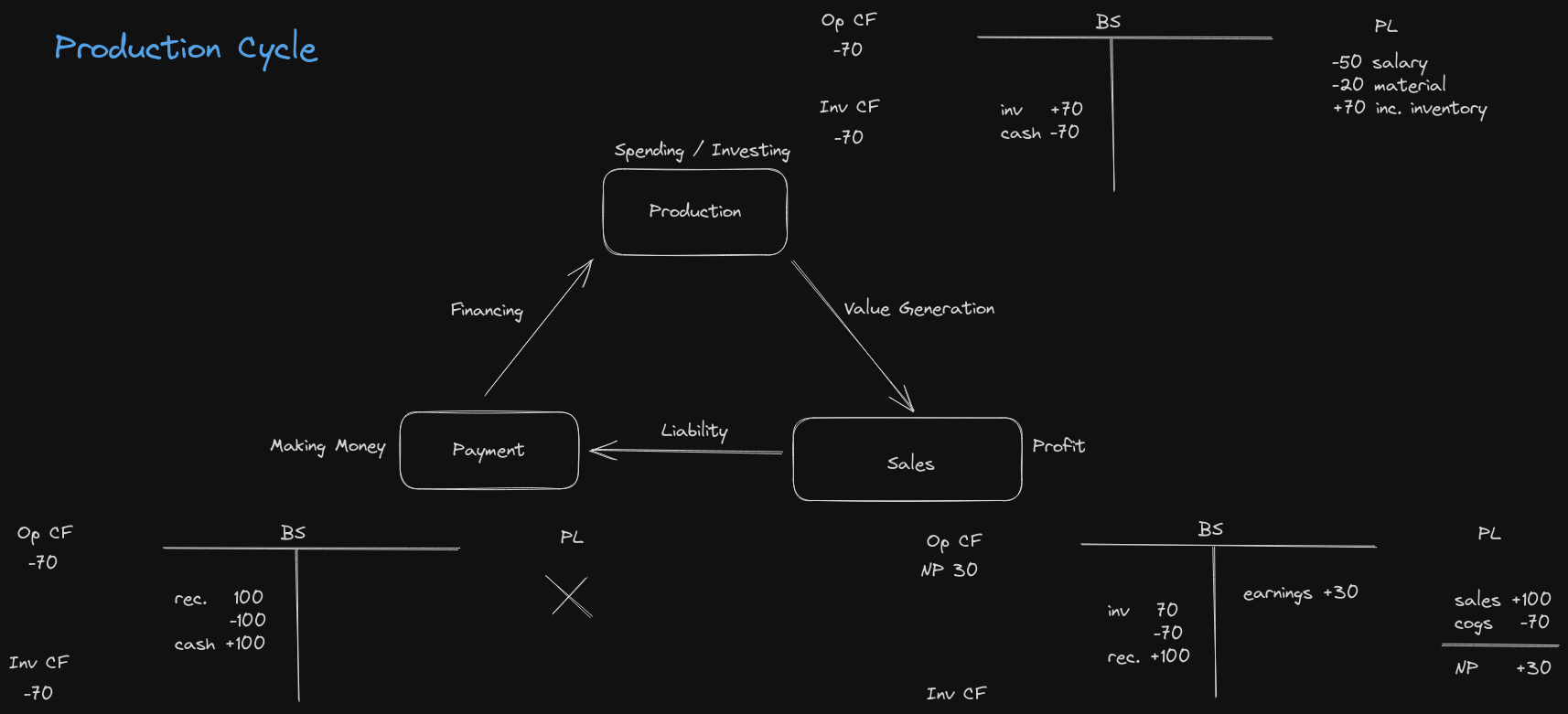

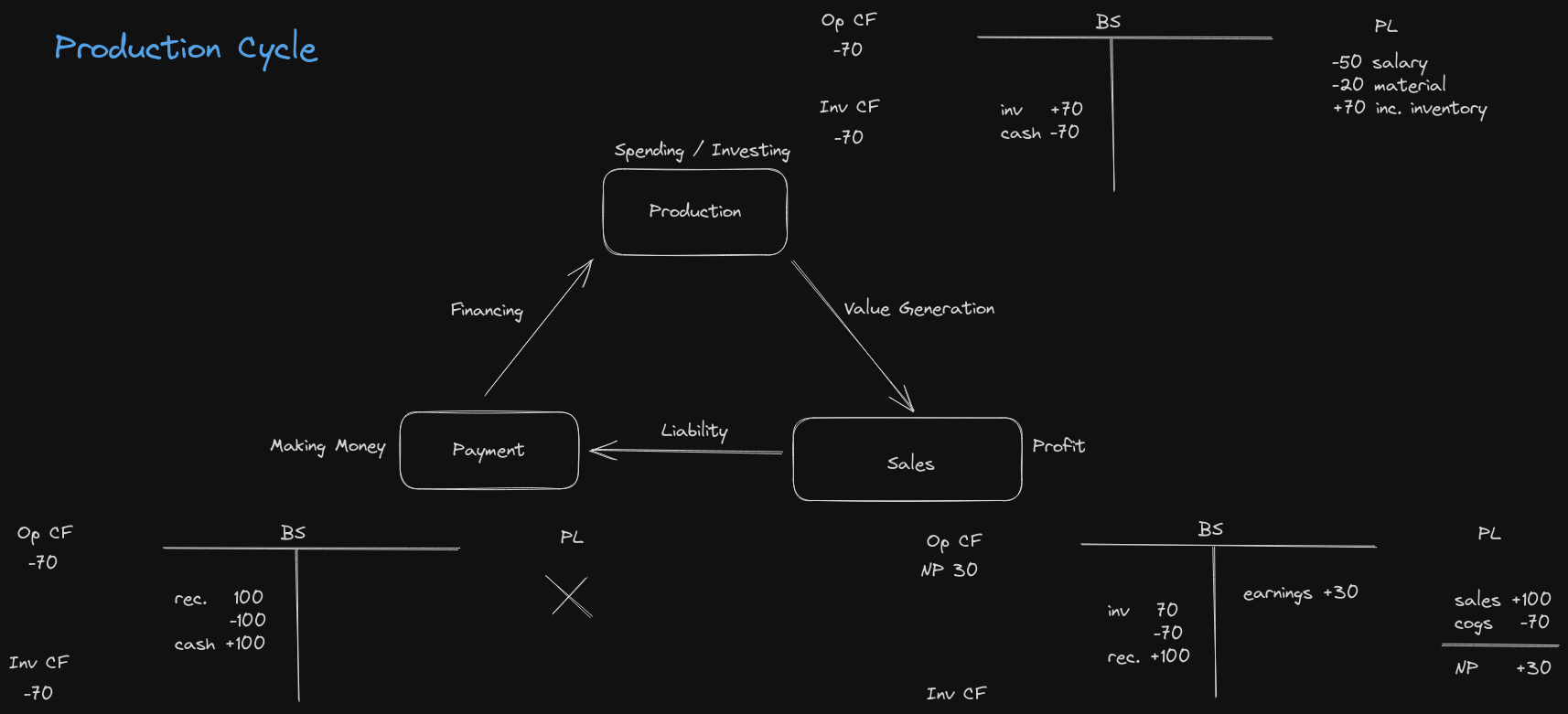

Working Capital Cycle

Transclude of Production_Cycle.excalidraw

Balance Sheet and P/L

- Buy Resources (+20 inventory, +20 liabilities)

- work-in-progress and finished goods

- Produce Products (+15 inventory, -15 cash)

- Sales → Receivables (+50 receivables, -35 inventory, +15 retained earnings)

- P/L (Sales +50, Cost of Goods Sold -35 = 15 Profit)

- Receivables → Cash Flow (+50 cash, -50 receivables) (P/L 0)

- Cash Flow → paying Payables (-20 cash, -20 liabilities)

- Produce or Buy Inventory → circle continues

Same with Cash Flow

- start with EBT: +15

-

- increase in inventory: -20

-

- increase in liabilities: +20

-

- spending in production: -15 ← actual cash flow

-

- reduction in inventory: +35

-

- increase in receivables: -50

- until here sum is 0 → no cash has flown yet

-

- decrease in receivables: +50 ← actual cash flow

-

- decrease in liability: -20 ← actual cash flow

- = +15 → positive cash flow