Globalization, Specialization, Free Markets

- integrated commodity markets

- greater world trade, broader range of goods

- Division of Labor

- industrial vs peripheral economies

Globalization - What?

- History

- fast growth between 1840 and 1900 - idea of progress

- 1918 - 1950 doubt about progress idea

- globalization

- globalization measured in Market Integration

- Movement of X goods, labor, capital, land more/easier

- movement of land … conquest of settlement, Imperialism, migration

- political, social, cultural, regulatory, etc implications

Specialization - What?

Glob and Spec - Why?

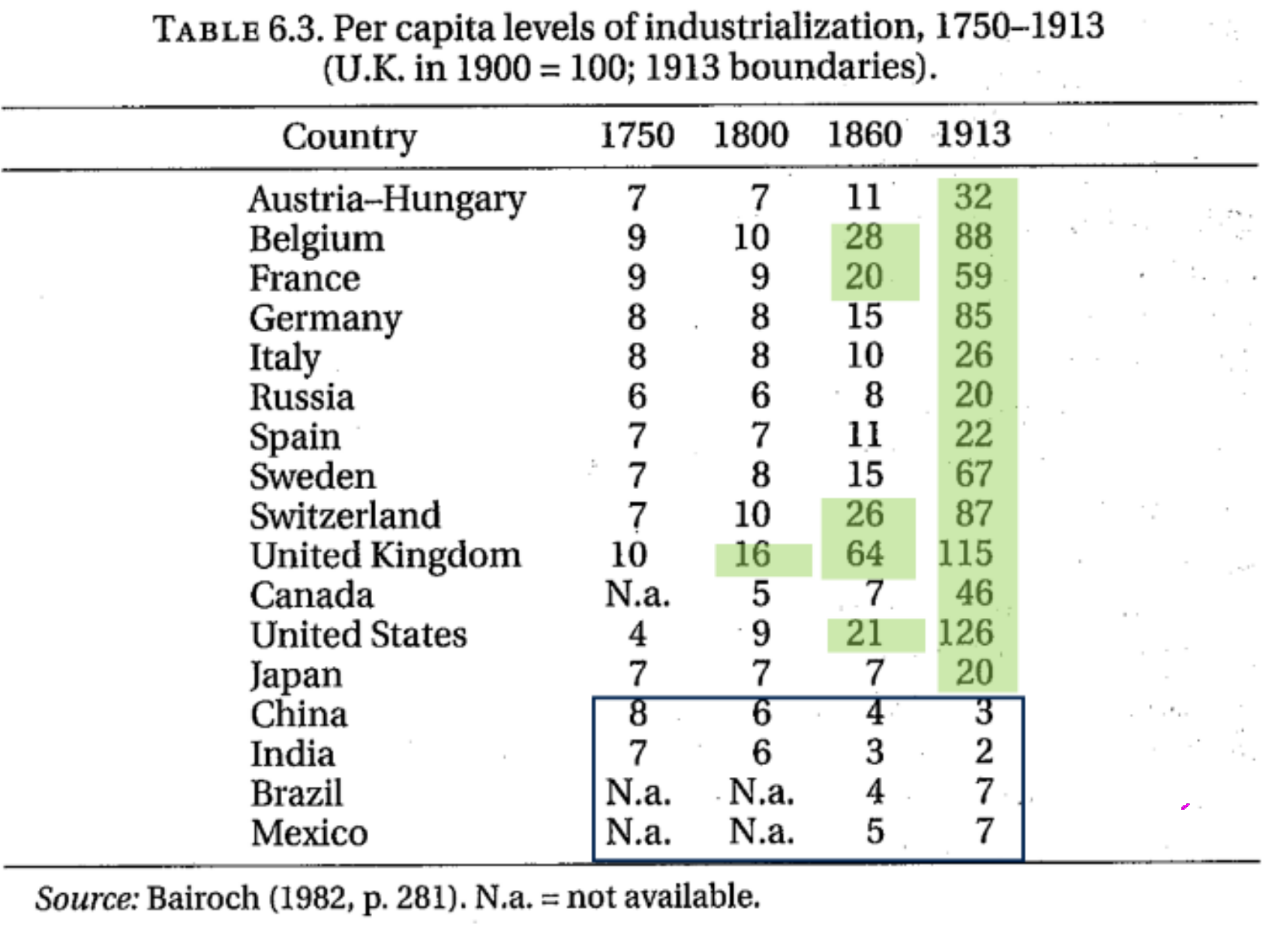

- industrial revolution spread from UK → Industrial Revolution … Again

- industrialization slow in the rest of the world

- value of 16 … industrialization level of UK in 1800

- value of 16 … industrialization level of UK in 1800

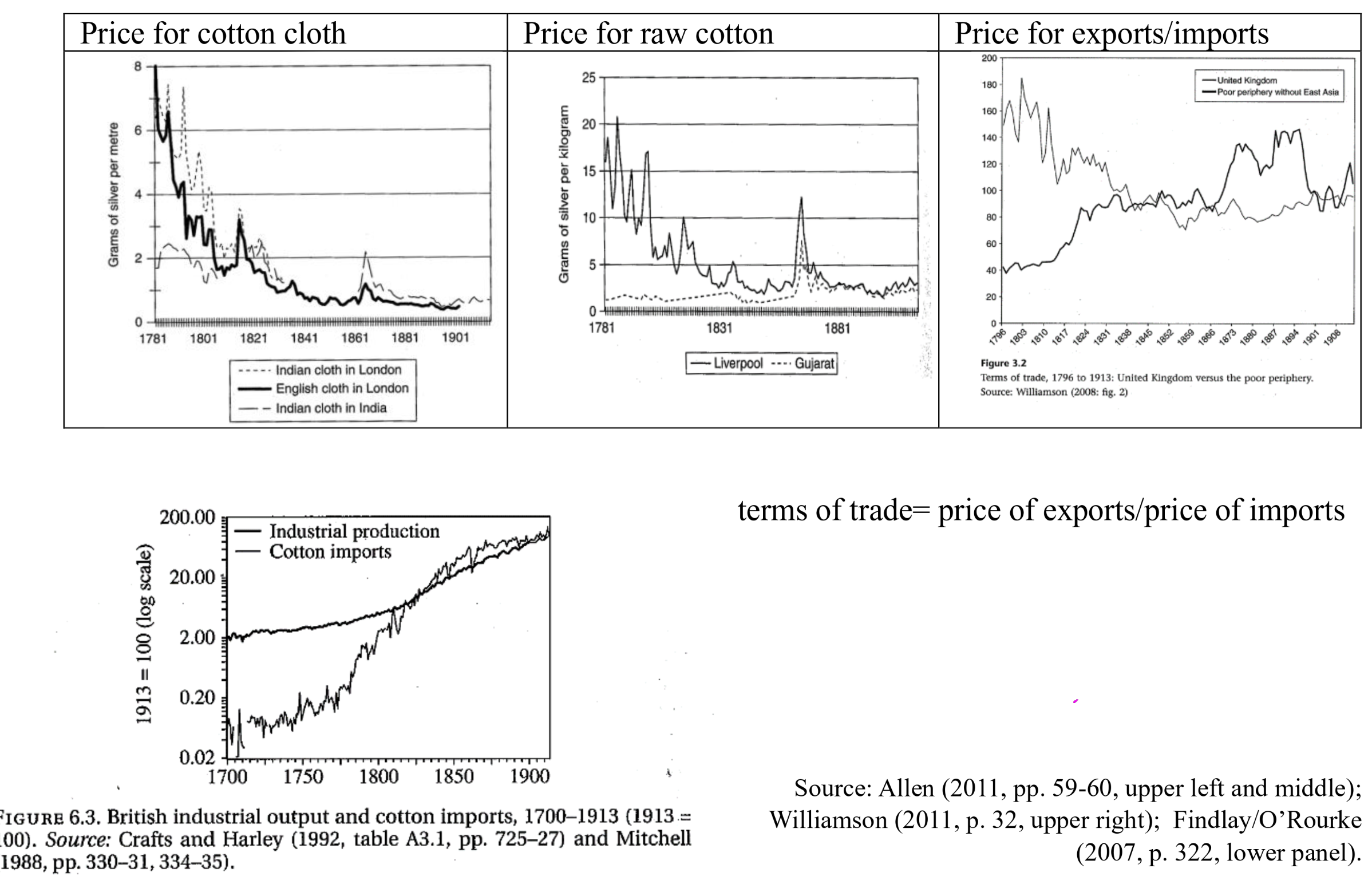

Role of Trade

- raw materials and food for core countries

- e.g. raw cotton to UK

- consume produced products

- e.g. cotton cloth from UK

- → Market Integration

- can overproduce locally and sell to other countries

- actively search for new markets

- slightly higher export prices over time

Trade and Transaction Costs

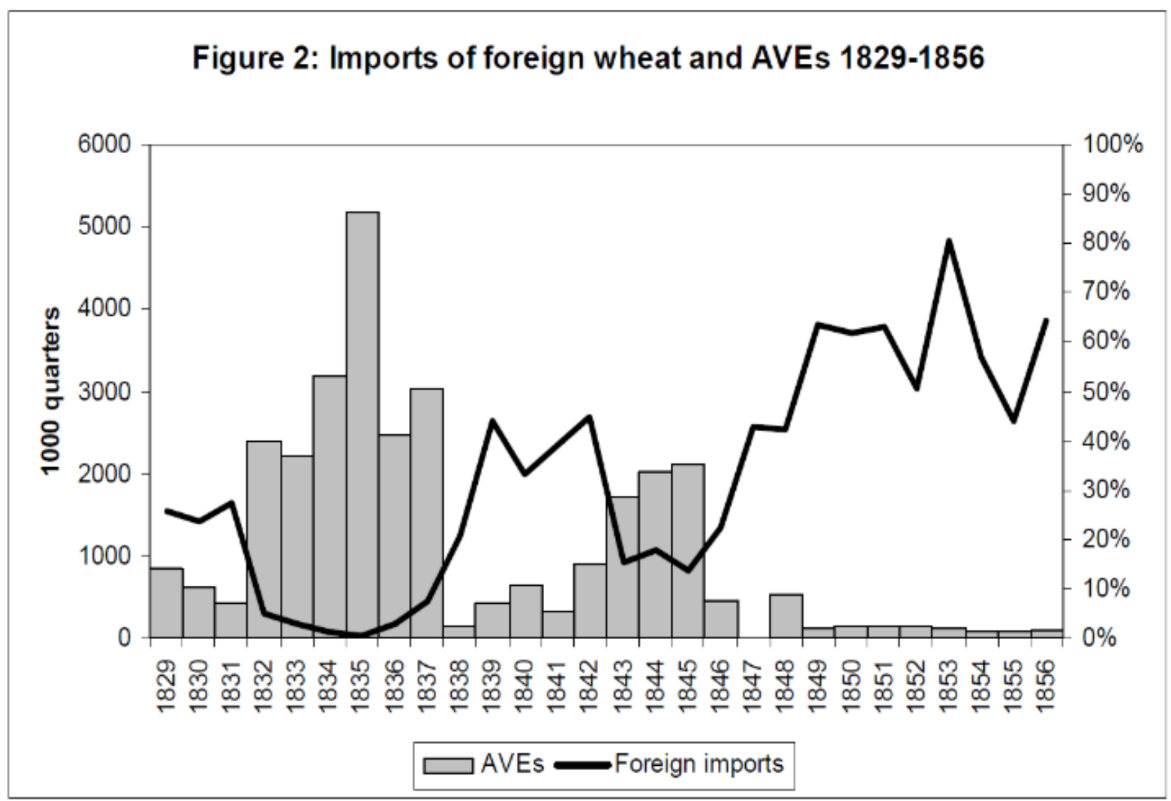

Trade Policy Liberalization

- lowered import/export tariffs (first in UK, then the rest)

- AVE … tariffs

example: japan opening after 1853

- Harris treaty of 1858

- Comparative Advantage emerged naturally

- Silk, silkworm eggs, tea exported

- cotton yarn, sugar, rice imported

- industrialization happening after opening

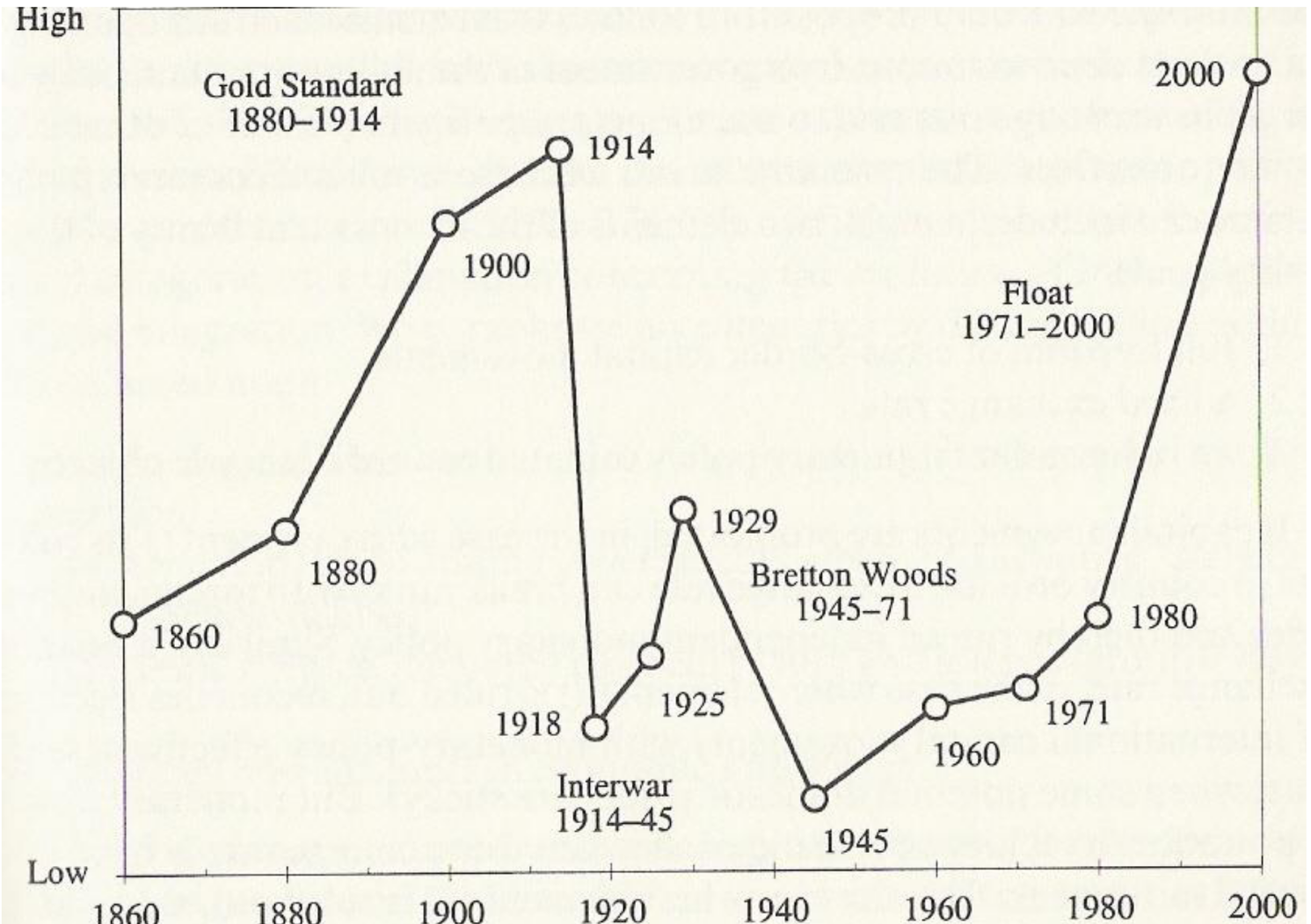

Gold Standard

Peace in Europe

- before 1815 europe in war all the time

- embargoes → cant trade with enemy

- privateering → private pirates instead of actual navies

- wartime → merchant ships converted into warships

- uncertainty

Imperialism

International Migration

- suitable cultivation areas used productively

- larger share of transnational vs national migration and greater total migration

- mostly from Britain (40%) to US (60%)

International Investment

-

90% of those investments from industrializing European areas which need raw materials

- exporting population for imports of raw materials

- North America, Europe, Latin America (Argentina Brazil), Ozeania

- 43% from Britain, 20% Franc, 13% Germany

- invenstments went where the migration went

- mostly Europe, US, Latin America; a bit of Asia too

- institutions similar to investment source

- Why invest abroad?

- higher returns on capital for increased uncertainty/risk

- migrating population younger than average, no/little savings

- if savings, spent on travel and setup

- high fertility rate, low savings in migrated locations → Script 2 Summary

- high need for infrastructure → high interest rates

- abundant land, secure institutions and good productivity → benefits of investments high too

Glob and Spec - Consequences

Prices converging

Consequences

- spread of industrialization

- source of growth

- core countries had 80% of the market

- core countries determined development of the rest of the world

- periphery countries were dependent on core countries and their relation to them